Firewalla launches its Purple gigabit home firewall

February 3, 2022

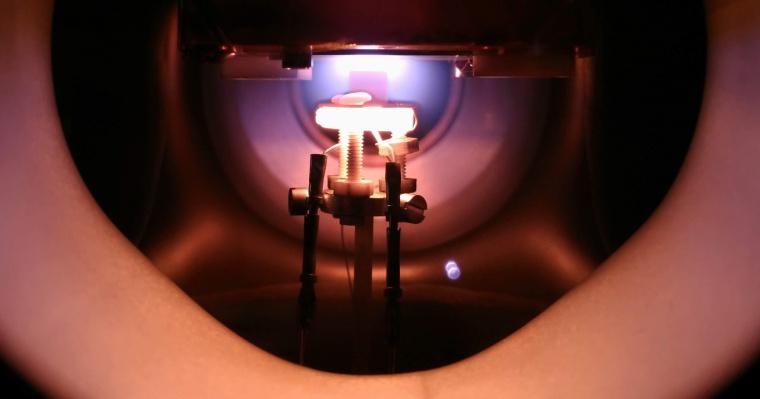

With a plan to decarbonize home heating with hydrogen, Modern Electron raises $30M

February 5, 2022

To get a roundup of TechCrunch’s biggest and most important stories delivered to your inbox every day at 3 p.m. PST, subscribe here.

Hello and welcome to Daily Crunch for Thursday, February 3, 2022! Today we have a few angles on the startup market. The gist is that there are some positive signals to digest, as well as some more cautionary data points. I think it nets out to a changing market, but not one that has settled on a new level of risk tolerance. What the heck does that mean? Read on!

But before we dig into the matter, don’t forget that Early Stage is coming up (it’s going to be great!) and that Mary Ann’s fintech newsletter is coming soon. You can sign up for it here. – Alex

Today’s startup news has a few Tiger rounds, a toilet paper headline and more. But first up is Natasha’s dive into Mos, which founder Amira Yahyaoui says is gunnin’ to become “the incumbent bank in the U.S.” The startup, which just raised $40 million, appears to link neobanking to the college student demographic and their peculiar needs.

Sticking just to the fintech theme, TechCrunch also has notes up on Pluto, which is building a corporate spend giant for the Middle East, backed by some of the most interesting founders in its own market, and Jar’s round that Tiger just led in India. Tiger also took a bite out of Bold, which just landed a $55 million round to “enable digital payments” in the Latin American market. The lesson? Fintech’s rise is increasingly a global story, with some models tested in the United States finding resonance in new markets.

And today in Good Headlines, Haje pulled off the following: “Flush with cash, bamboo-based toilet paper company Cloud Paper makes it rain.”

Image Credits: Lyu Liang / VCG / Getty Images)

Image Credits: Lyu Liang / VCG / Getty Images)

“You’ve got to spend money to make money” is a cliché, but if you’re building a company that hopes to compete in the cloud, it’s a fact.

This week, Google Cloud reported $5.5 billion in revenue for Q4 2021, but “that was the good news,” reports Ron Miller and Alex Wilhelm.

“The bad news was that Google Cloud accrued operating losses worth $890 million at the same time.”

Given such high stakes, industry watchers don’t seem overly concerned by these ongoing losses, however.

“Businesses of this nature require a lot of upfront investment and buildout of infrastructure and often don’t break even for several years,” said John Dinsdale, chief analyst at Synergy Research.

(TechCrunch+ is our membership program, which helps founders and startup teams get ahead. You can sign up here.)

With a $22B run rate, does it matter if Google Cloud still loses money?

Image Credits: SEAN GLADWELL / Getty Images

Image Credits: SEAN GLADWELL / Getty Images

TechCrunch wants you to recommend growth marketers who have expertise in SEO, social, content writing and more! If you’re a growth marketer, pass this survey along to your clients; we’d like to hear about why they loved working with you.

If you’re curious about how these surveys are shaping our coverage, check out this article on TechCrunch from Jonathan Martinez: “Tackling touchpoints on your customer’s path to purchase.”