China smartphone market slumps to 10-year low in 2022

January 31, 2023

Raylo raises $136M to build out its gadget lease-and-reuse ‘fintech’ platform

January 31, 2023

The Station is a weekly newsletter dedicated to all things transportation. Sign up here — just click The Station — to receive the full edition of the newsletter every weekend in your inbox. Subscribe for free.

Welcome back to The Station, your central hub for all past, present and future means of moving people and packages from Point A to Point B.

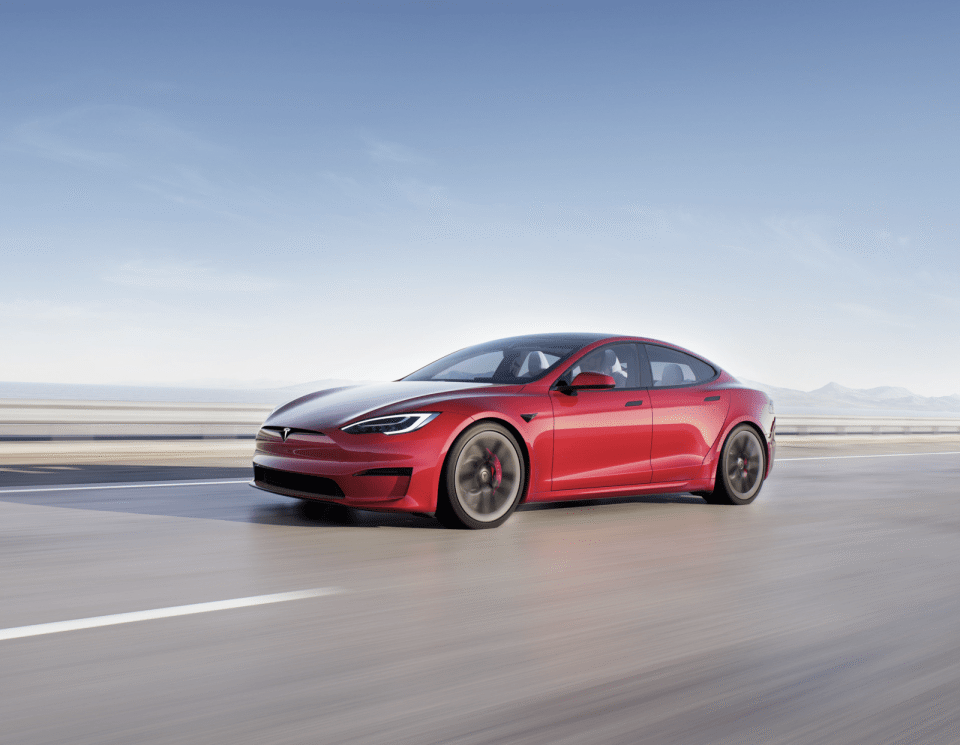

It seems we can’t get through a week without discussing something related to Tesla. The company announced a new investment in its Nevada gigafactory and shared Q4 earnings (more on that later). But much of the attention was directed at the class-action securities fraud trial that kicked off earlier this month in San Francisco. Tesla shareholders who traded the company’s stock in the days after CEO Elon Musk’s infamous 2018 tweet that stated funding was “secured” to take Tesla private at a potential value of $420 per share are suing the executive for billions of dollars in damages.

This week, lawyers on either side of the courtroom engaged in a verbal tug of war over the intent of Musk’s “funding secured” tweet — a question that they tried to answer during his testimony by picking apart emails, phone calls and boardroom conversations. The words “drudgery” and “mind numbing” came to mind more than once as the sparring over whether Musk knew he was being negligent was hashed out.

There were a couple of tidbits that came out of the whole debacle. Musk testified that his $420 per share reference was not a joke or a reference to weed culture, but rather it was a 20% premium over the stock price at the time. Sure, sure …

Musk also disclosed that he thought funding was secured from the Saudi Arabia’s Public Investment Fund, and that even if he didn’t, he would have sold SpaceX shares to fund the buyout, much like he sold Tesla shares to fund Twitter. Wonder why he didn’t share that five years ago?

Perhaps the biggest automotive story of the week was Akio Toyoda’s surprise announcement that he is stepping out of the CEO driver seat at Toyota and handing the keys to Koji Sato, who most recently led the automaker’s luxury brand Lexus.

Akio Toyoda isn’t leaving Toyota altogether. He will now become chairman of the board, replacing Takeshi Uchiyamada, who held the position since 2013. The company has said the change to management was triggered by Uchiyamada’s resignation.

Toyoda and Sato made remarks during a livestreamed Toyota event and a few nuggets stood out to me.

One was Toyoda commenting on his 13 years as CEO, an era when the company suffered due to the global financial crisis, earthquake and a worldwide recall:

I believe that in times of crisis, two paths appear before us. One is a path toward short-term success or a quick victory. The other is a path that leads back to the essential qualities and philosophies that gave us strength.

I chose the latter.

And Sato on the future:

I love making cars. For that reason, I want to be a president who continues to make cars. I would like to show what kind of company Toyota should be through our cars. That’s what I want to do.

Cars that are fun to drive and cars that support mobility. And cars in the future will evolve into the concept of mobility itself. Amid such, I hope to preserve the essential value of the car and propose new forms of mobility.

You can drop us a note at [email protected]. If you prefer to remain anonymous, click here to contact us, which includes SecureDrop (instructions here) and various encrypted messaging apps.

Micromobbin’

This was a pretty slow week in the micromobility realm, but there are a few morsels worth sharing.

Bike New York, a nonprofit org, is providing immigrants and asylum seekers with two wheels.

California will soon be the latest state to offer rebates for e-bikes. The state is gearing up to launch up to $13 million in funding.

Citibike has raised membership and single-trip prices in Jersey City and Hoboken. Will other markets follow?

Helbiz wants to address short selling of its stock. The company signed a deal with Shareholder Intelligence Services to stop any illegal short selling.

Honda Motorcycle is set to launch sit-down e-scooters in 2024 for the Indian market.

Madrid has selected Lime, Dott and Tier for scooter licenses. The permits are good for three years, which is a step up on many permits that only last a year or two.

Tier has announced more layoffs across its own brand and Spin. This follows previous rounds of layoffs from both companies. Tier said it would let go 80 workers from Tier and another 20 from Spin as it pivots its strategy from growth at all costs to sustainable growth.

Veo donated 36 decommissioned bikes to a Bronx school.

Deal of the week

There wasn’t one big deal that caught our attention this week, so here are a few smaller ones that you should know about.

Ampeco, a Bulgarian EV charging management platform, raised a $13 million Series A led by BMW iVentures to drive into North America.

Caura, an administrative app for drivers, raised £4 million ($5 million) from LLoyds Banking Group Plc. The four-year-old company is also backed by Jaguar Land Rover’s venture arm.

Geely is planning a big investment to turn London’s iconic black taxis into a high-volume, all-electric brand with a range of commercial and passenger vehicles.

Log9 Materials, an India-based battery tech startup, raised $40 million in a Series B round of equity and debt co-led by Amara Raja Batteries and Petronas Ventures. Incred Financial Services, Unity Small Finance Bank, Oxyzo Financial Services and Western Capital Advisors also participated.

Onto raised a £100 million line of credit from CDPQ to continue expanding its U.K. fleet with the latest electric car models.

Sheeva.AI, a company that developed an in-car payments and commerce platform based on a vehicle’s location, raised $9.25 million in a Series A funding round led by strategic investor Reynolds and Reynolds Company, with additional funding from Poppe + Potthoff Capital GmbH and Pegasus Tech Ventures.

Terra Drone raised a $14 million Series C from Wa’ed Ventures, the VC arm of Saudi Arabia’s public oil and gas company, Saudi Aramco.

Virgin Australia is expected to begin interviewing lead underwriters for a planned IPO in 2023.

Notable reads and other tidbits

ADAS

Tesla’s Autopilot fell in a Consumer Reports ranking of 12 major systems. Ford’s BlueCruise ranked the highest, followed by General Motors’ Cadillac Super Cruise and Mercedes-Benz Driver Assistance. Autopilot came in seventh place.

Autonomous vehicles

Vay received an exemption permit to test its remotely piloted cars on public roads in Germany.

Waymo quietly laid off staff as its parent company Alphabet let go of 12,000 workers.

Also missed this one last week. Waymo was named the official autonomous vehicle technology partner of Super Bowl LVII, which will be held in Phoenix this year. “There’s no bigger stage for our 24/7 ride-hailing service than transporting people from all over the globe to and from the airport and around downtown for the many exciting activities surrounding the Big Game,” Waymo’s chief product officer Saswat Panigrahi said in a statement.

Electric vehicles

Bluedot is a startup that offers a debit card for EV drivers, offering them rewards and discounts on EV charging and other auto-related services.

Honda will establish a division dedicated to developing EVs and other electrical products like storage and generation.

Lightyear has stopped production on its Lightyear 0, the company’s €250,000 flagship solar-powered EV. It will instead redirect its attention to its second production model, the Lightyear 2, which will come in at a modest €40,000.

Tesla reported Q4 and full-year earnings this week. The company beat Wall Street estimates with $24.3 billion in the fourth quarter. Tesla also reached record deployments for its energy offerings. Separately, Tesla invested $3.6 billion into building two new facilities in Nevada: a 100 GWh battery cell factory and the company’s first high-volume Semi truck factory.

Toyota is partnering with Enel X Way to make the latter’s domestic and street charging services available to Toyota and Lexus drivers. Volta Trucks has announced first production orders of over 300 electric EVs and more than €85 million in associated revenue.

Ride-hail

Gig workers in India on platforms like Uber, Ola and Swiggy are facing blocked accounts and other backlash for speaking out and protesting over poor working conditions.

Lyft has introduced wait-time fees, or charges incurred if a Lyft driver has to wait for a rider upon pickup. Uber has had them since 2016. Lyft’s new fees kick in two minutes after on-time arrival for standard rides and five minutes after Black and Black XL.

Uber CEO Dara Khosrowshahi said the company is not planning any widespread job cuts. Here’s holding him to his word.

People

Canoo named Ken Manget as its CFO. Ramesh Murthy, who served as interim CFO, will continue in his role as senior vice president of finance and chief accounting officer.