Metalenz PolarEyes upgrades digital sensing with polarized light

January 20, 2022

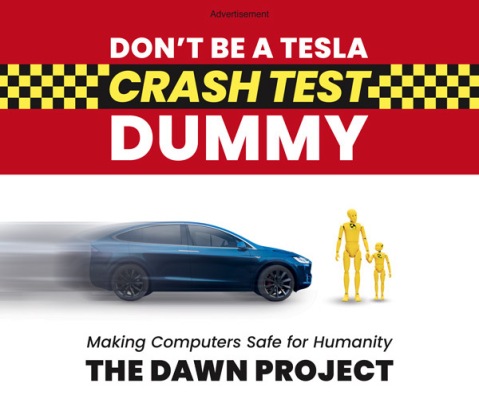

New York Times ad warns against Tesla’s “Full Self-Driving”

January 21, 2022

Tesla’s shareholders have urged a judge to find that CEO Elon Musk coerced the company’s board to acquire SolarCity in 2016, a transaction that a group of shareholders allege was a “bailout” of the failing solar company of which Musk was the top shareholder. During a Zoom hearing on Tuesday, the shareholders asked that Musk be ordered to return the stock he received from the deal and pay Tesla $13 billion.

The all-stock deal was valued at $2.6 billion at the time, but Tesla stock has gone up massively since then.

In July 2021, Musk testified in a 10-day lawsuit over the acquisition, with his lawyers saying the CEO recused himself from board discussions and negotiations relating to the acquisition of SolarCity, a purchase that was approved by 85% of shareholders at the time. The resounding question is whether or not Musk exerted undue influence over the transaction and whether he and other board members concealed information relating to the transaction from shareholders.

“This case has always been about whether the acquisition of SolarCity was a rescue from financial distress, a bailout, orchestrated by Elon Musk,” said Randy Baron, an attorney for shareholders, at the hearing, Reuters reported.

The lawsuit by union pension funds and asset managers said that SolarCity “had consistently failed to turn a profit, had mounting debt, and was burning through cash at an unsustainable rate,” noting that the company had accumulated over $3 billion in debt in its 10-year history, nearly half of which was due for repayment by 2017.

Musk’s attorney’s argued back in July that the acquisition was part of the CEO’s long-term vision to transform Tesla into an energy company. The CEO has said that combining SolarCity and Tesla was the key to his vision of combining Tesla’s battery storage product, Powerwall, with its solar roof panels.

“They were building billions of dollars of long-term value,” said Chesler, according to Reuters.

Things got a bit spicy when shareholder attorney Lee Rudy asked Vice Chancellor Joseph Slights of Delaware’s Court of Chancery to consider the contempt Musk held for the deposition and trial process, in which he repeatedly insulted shareholder attorneys.

Slights said he expects to rule in about three months, around the same time he expects to retire. A related shareholder lawsuit challenging Musk’s giant pay package was transferred from Slights to another judge.