NASA celebrates private sector deployments of space-born tech in its latest Spinoff

January 25, 2022

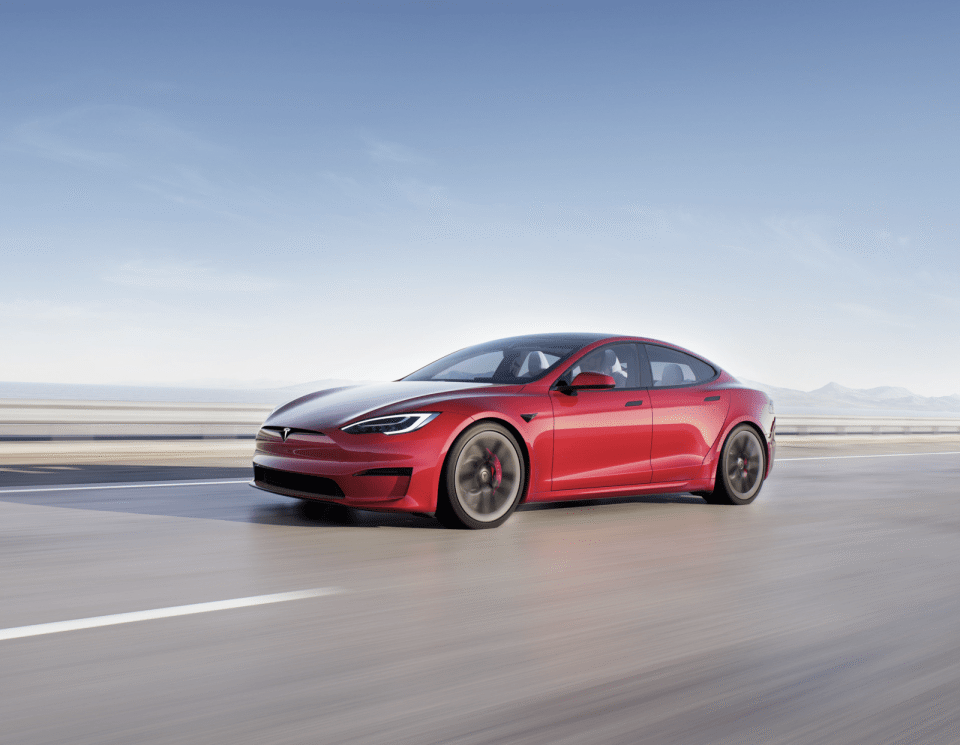

Panasonic’s higher-capacity Tesla battery could enter production in 2023

January 25, 2022

The Station is a weekly newsletter dedicated to all things transportation. Sign up here — just click The Station — to receive it every weekend in your inbox.

Hello readers: Welcome to The Station, your central hub for all past, present and future means of moving people and packages from Point A to Point B.

Amid the deal-making and partnership news this week, one item raised both of my eyebrows. Although I must admit, I wasn’t exactly surprised. I’m talking about the Insurance Institute for Highway Safety and its plans to develop a new rating program that will evaluate the safeguards that vehicles with “partial automation” use to help drivers stay focused on the road.

IIHS, a nonprofit that is funded by auto insurance companies, will give systems good, acceptable, marginal or poor ratings. The first set of ratings is expected to be issued in 2022, IIHS said, though it did not give a specific date because ongoing supply chain issues have made it more difficult to obtain vehicles for testing.

The organization’s takeaway? Not a single advanced driver assistance system offered in today’s new vehicles would meet its pending safety criteria. You can read my full coverage of this here; but for those who don’t click that link, here are two important items to consider:

Side note: Consumer Reports’ 2022 autos Top Picks, which will be announced on February 17, will include evaluations of driver monitoring systems. CR will add two points to a vehicle’s overall score if it features a system that encourages safe driving as part of the model’s active driving assistance package.

One final (maybe fun?) item. I went back and looked at my predictions for 2021. They’re all here in The Station edition from January 11, 2021 (this is the second part, but I also recap the first part at the bottom). Check it out, and give me a grade. ;D

As always, you can email me at [email protected] to share thoughts, criticisms, opinions or tips. You also can send a direct message to me at Twitter — @kirstenkorosec.

Let’s talk a little about how cities are embracing micromobility, and how they can improve.

Transport for London recently released stats that showed the share of journeys made in the city by cycling or walking has increased from 27% to 42% during the pandemic. Even more promising is the National Bicycle Dealers Association’s Bicycling Buying 2021 Consumer Research study, which found 56% of female bicyclists who are riding today either started cycling or returned to it during the pandemic.

All great signs that the momentum is here, but cities need to step up their infrastructure game. A survey from Victoria, Australia found that 75% of respondents are interested in biking, but are concerned about lack of safety infrastructure. The Aussies are no doubt not the only ones.

But it doesn’t only come down to infrastructure. Cities also need to be working with micromobility companies to ensure easy and affordable access to bikes and scooters. Look at Prague as an example. The city recently decided to make free 15-minute bikeshare rides a permanent part of its public transport offer. New York City is also working with Brooklyn-based bike and scooter subscription service Beyond to study how micromobility can be integrated with public transit.

(NYC is also working with Lyft to offer free 60-day Citibike memberships to public and private hospital workers who are battling rising COVID-19 Omicron cases.)

Speaking of which, yet another micromobility startup, Helbiz, is integrating with Google Maps worldwide, which will no doubt help micromobility become more a part of the broader transit ecosystem.

Meanwhile, Stockholm is actually reducing the number of shared e-scooters in the city by 50% because of the apparent chaos of 23,000 scooters roaming around. The city will allow all eight of its current micromobility providers to continue operating a reduced service. While I initially wince at the thought of cutting back greener forms of transit, public opinion is important for long-term adoption. A recent survey of Stockholmers found 57% were negative about e-scooters, versus 50% last year.

In other news…

HumanForest is partnering with Deliveroo to give London delivery workers access to shared e-bikes. The company also just ran the first of what will be multiple challenges to encourage sustainable riding among its customers. The first, called the “CO2 Saver” took place from January 17 to 23, and involves riders monitoring the amount of CO2 they saved from being emitted, the hours they spent outside and the amount of energy they burned through cycling. The winners are rewarded with TreeCoins, or points that can be used toward rides.

Gogoro is doing a second vehicle collab with Yamaha to produce the Yamaha EMF, which is built from the ground up to utilize Gogoro’s battery swapping platform. The EMF will be available in Taiwan in March.

Bird published a blog post that dug into its battery management system, which runs real-time diagnostics and sets dynamic power limits on the operator’s IP68-rated battery cell packs for e-scooters, while communicating directly with the e-scooters’ CAN bus. Bird’s BMS allows the company to monitor and take action on any safety or sustainability issues like battery failures.

— Rebecca Bellan

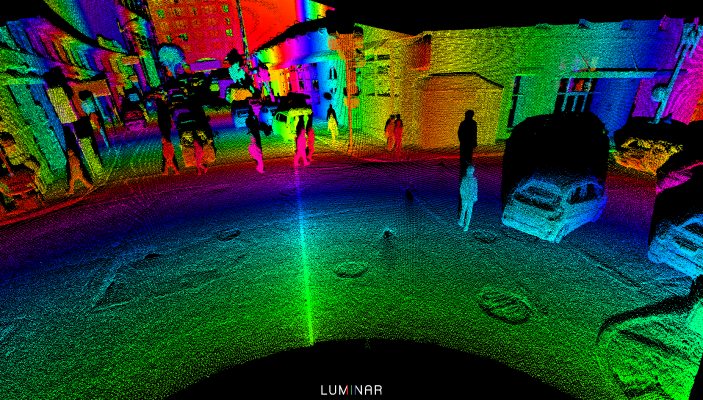

OK, so this isn’t a traditional company X raises $$$ type of deal, but this week we’re mixing it up. I find this item notable because it illustrates increasing interest from traditional automakers to use lidar in passenger vehicles.

The gist: Mercedes-Benz agreed to use Luminar’s lidar technology in future vehicles as part of a broader deal that includes data sharing and the automaker taking a small stake in the company. Mercedes-Benz will acquire up to 1.5 million Luminar shares, in exchange for certain data and services.

The companies declined to share information about when Luminar lidar would be integrated into Mercedes-Benz vehicles. I went back and listened to an interview I had with Markus Schäfer, Daimler AG board member and Mercedes-Benz AG’s CTO responsible for development and procurement. We were talking about the EQXX Vision, a halo car of sorts that was revealed earlier this month ahead of the CES tech trade show.

The vehicle, which went from idea to prototype in 18 months, is meant be the foundation for its future electric vehicles and it featured all sorts of technological innovations with the battery and drivetrain, as well as other items that Schäfer said will be in Mercedes-Benz electric vehicles beginning in 2024.

Perhaps Luminar’s lidar will also show up in 2024 model year Mercedes vehicles.

Other deals that got my attention …

Factorial Energy raised $200 million as part of a Series D round of funding that was led by automakers Mercedes-Benz and Stellantis. The company said the funding will be used to accelerate commercial production and deployment of its solid-state battery technology.

Gogoro, the Taiwanese company best known for its electric smartscooters and swappable battery infrastructure, has just added to its PIPE investment current strategic partner Hero MotoCorp, activist and impact investment firm Engine No. 1 and another investor, bringing the total funding to $285 million, up from $257 million. The company still intends to complete its SPAC deal with Poema Global by the end of this quarter.

Monta, the electric vehicle charging platform, closed a $15 million Series A funding round led by Creandum, an early-stage venture capital firm based in Stockholm. The company said that Headline also made a significant investment.

Parallel Systems, a company founded by three former SpaceX engineers to build autonomous battery-electric rail vehicles, came out of stealth mode with a $49.55 million Series A raise. The company, which has raised $53.15 million to date, including a $3.6 million seed round, is working to create a more efficient, decarbonized freight network that flows on top of existing railway infrastructure.

Phantom Auto, a startup that has developed remote operation software for vehicles, received a strategic investment of $42 million led by freight and logistics service provider ArcBest and NFI. As part of the deal, ArcBest and NFI reached a commercial agreement to deploy thousands of Phantom-powered forklifts in the coming years. The funding also includes investment from Bessemer Venture Partners, Maniv Mobility, Perot Jain and other previous investors. Phantom Auto initially focused on the autonomous vehicle industry, but pivoted to logistics vehicles like forklifts. Last March, global logistics company Geodis tapped Phantom Auto to help it deploy remotely operated forklifts at two sites and eventually expand to other warehouses.

Mitsubishi Electric, the automaker’s electronics equipment manufacturing company, is starting a pilot program to explore the value of autonomous robots. The company will be working with Cartken, the Google alum startup that came out of stealth last March, to unleash a small number of Cartken’s delivery robots in a Japanese mall to provide indoor and curb-side food delivery services, initially for Starbucks customers.

Blink Charging, the electric vehicle charger manufacturer, will deploy EV chargers at General Motors dealerships across the U.S. and Canada. The startup will be teaming up with facility solutions provider ABM to supply its new IQ 200 Level 2 chargers to GM. Blink said it has around 30,000 EV chargers set up across 13 countries; this deal might help Blink gain more brand recognition and compete with companies with larger market share.

Electrek rounds up every EV that still qualifies for the U.S. federal tax credit.

Scott Painter, who founded auto pricing company TrueCar Inc. and car subscription service Fair, has a new thing going. Painter launched a company in 2020 called NextCar that was supposed to be a B2B type business that sold a software-as-a-service platform to vehicle subscription providers. NextCar Holdings remains, but under it a new company called “Autonomy” has been born. Autonomy will be a consumer-facing business that lets customers rent a Tesla Model 3 for a flat monthly fee. Painter told Automotive News that it is “not a traditional lease or car loan.”

Volkswagen is bringing back the e-Up minicar, according to German news site Golem.

Ford signed a five-year agreement with online payment processor Stripe to scale the automaker’s e-commerce capabilities. Stripe will facilitate transactions for vehicle orders and reservations, handle financing options for Ford’s commercial customers and route customer’s payments from the automaker’s website to the correct local Ford or Lincoln dealer. Ford said it plans to begin rolling out Stripe’s technology in the second half of 2022, starting with North America.

General Motors plans to expand its hydrogen fuel cell business and apply the technology to other commercial applications beyond vehicles, including power generators used for the military and EV chargers. GM’s branded Hydrotec fuel cell technology is currently in development for use in heavy-duty trucks, aerospace and locomotives.

Hyundai is partnering with quantum computer maker IonQ to develop new variational quantum eigensolver (VQE) algorithms. Why? The plan is to use these quantum algoritums to study lithium compounds and their chemical reactions involved in battery chemistry. The aim is to develop batteries that are cheaper, safer and have better performance.

Tesla shareholders urged a judge to find that CEO Elon Musk coerced the company’s board to acquire SolarCity in 2016, a transaction that a group of shareholders allege was a “bailout” of the failing solar company of which Musk was the top shareholder. During a Zoom hearing on Tuesday, the shareholders asked that Musk be ordered to return the stock he received from the deal and pay Tesla $13 billion.

Volkswagen and Bosch have signed a memorandum of understanding to explore a joint venture dedicated to providing Europe with battery equipment solutions. The two companies aim to supply integrated battery production systems and on-site ramp-up and maintenance support for battery cell and system manufacturers. The JV is expected to help VW reach its goal to build six cell factories by 2030, but it will also be available to serve other factories across Europe.