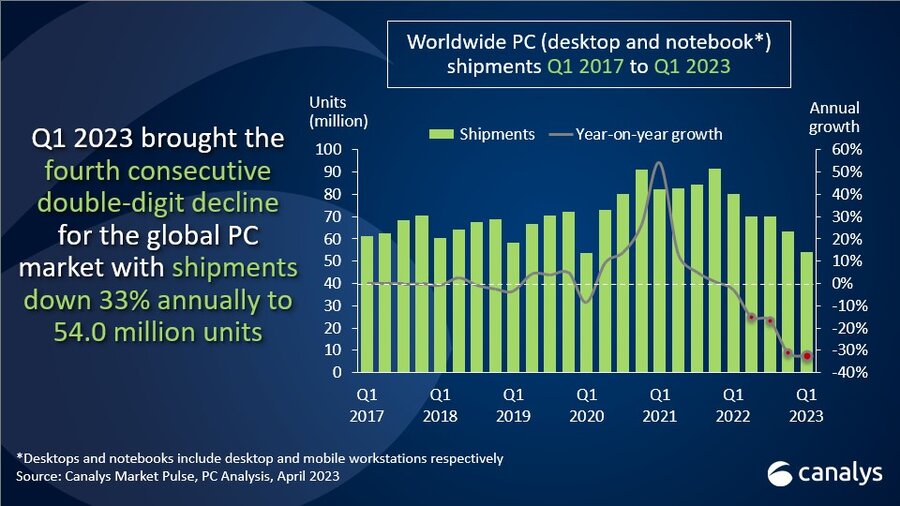

Global PC shipments dropped by a third in Q1

April 11, 2023

Internet abuzz over suspected redesigned Tesla Model 3

April 15, 2023

Turo, the peer-to-peer car rental company, plans to block access to third-party services like CarSync and Fleetwire starting April 30, according to an email that hosts received and TechCrunch viewed.

Turo confirmed the move, which hosts say will cut them off from essential fleet management tools that allow them to share multiple cars on the platform. While there is evidence that Turo intends to build many of these services within its own app, that hasn’t assuaged hosts who rely on these third-party services today.

About 24,000 of Turo’s hosts rent out more than three vehicles on the peer-to-peer car rental platform. They use CarSync and Fleetwire to manage their fleets and toll payments, as well as provide other useful services that have historically been absent from Turo’s app.

Turo’s plans have sparked panic among many hosts, who have turned to social media platforms and even petitions on Change.org to argue the change threatens their businesses.

The blowback comes at a tricky time for Turo, which appears to be on the precipice of becoming a publicly traded company two years after filing confidentially for an IPO.

Turo recently updated its S-1 with the Securities and Exchange Commission with its 2022 financials. The results show a company that has emerged from the pandemic doldrums with rapid revenue growth and healthy levels of profitability.

But Turo still has work to do to shore up its finances. A key target is to increase the supply of vehicles available to guests by converting so-called “consumer hosts” who rent out one or two vehicles on the platform into “small business and professional hosts.” Small business hosts share three to nine cars, and professional hosts share 10 or more.

As of December 31, about 85% of Turo’s 160,000 active hosts were consumer hosts. In order to shift those percentages, Turo needs to provide more incentives to hosts and make the process of renting out their vehicles a lot easier.

So why, hosts are asking, would the company choose to remove the tools they use to grow and manage their fleets?

Security appears to be a top concern, according to its S-1 and communications with its hosts. In the email sent to hosts, a Turo representative said the company had been made aware of “potential security risks” that can be created by third-party services. Turo also lists security as one of the risk factors included in its S-1 filings.

“Over the next few weeks, Turo will be releasing new features centered around enhancing vehicle pricing and management, toll automation and co-hosting,” said the email. Co-hosting allows hosts to bring someone on to help them manage their listings. “These new features will help you run your business as efficiently as possible.”

Turo told TechCrunch the features would be rolling out in the next weeks and months, but didn’t say which features would be made available first.

It’s clear that Turo is keen to bring more features in-house. What makes Turo hosts nervous is the timing — one month to try to replicate all that CarSync and Fleetwire do — and Turo’s track record when it comes to innovating on the platform.

“I’d be surprised if a small fraction of [the features] are replaced in the next year,” wrote one Reddit user. “It took 10 years to get scheduled messages and photos within messages.”

Actually, it took 13 years. Turo was founded in 2009 and launched scheduled messages and photos in messages last year.

Hosts also don’t buy that Turo believes there’s a security risk. CarSync, a platform that hosts seem to value highly, told TechCrunch it hadn’t experienced a breach.

“It didn’t come as a surprise because we knew they were building similar features, but we didn’t think those features were ready or launched yet,” Nikola Mihajlovic, CarSync’s co-founder and chief technology officer, told TechCrunch. “So that was surprising, given the timeline. None of the hosts have seen anything new yet.”

CarSync hosts 40,000 vehicles from Turo hosts on its platform, according to Mihajlovic. That’s about 12.5% of total Turo vehicles. Sources familiar with the matter told TechCrunch that Turo had been trying to acquire CarSync, but a deal could not be reached.

Turo’s real risk

Anthony Navarro, a host who rents out a fleet of eight Teslas in the Denver area, told TechCrunch that Turo has never had great tools for managing a fleet, and he’s worried that it’ll get much harder to get a return on his vehicle investment without CarSync.

“From what I have seen, people are looking at other platforms and even trying to do private rentals,” said Navarro when asked if he thought hosts would leave Turo for one of its competitors, like Getaround. “But Turo is still the largest platform and so I think that people will either try to make it work or they will try to exit the business.”

Navarro said large fleets might be able to adapt, but people like him with a medium-sized fleet who do Turo on the side will start contemplating if they want to stay in this business at all.

“For me, it is a hard time to exit because of how much the used Tesla market has dropped and what I still owe. But after the summer, I might re-evaluate,” he said.

A letter to Turo signed by Tesla Turo United, a collective of Turo power and all-star hosts who own Teslas, shared similar sentiments, saying that CarSync offers more reliable and varied automated messages than Turo’s messaging system.

The letter, which TechCrunch viewed, also says CarSync completely automates Supercharger reimbursements, a tool that’s not “merely a helpful tool for us, it is basically a necessity.” Without that tool, they have to manually copy and paste Supercharger costs from the Tesla app, which the letter describes as “a soul-draining, time-wasting process.”

“CarSync’s magic is that it integrates with both Tesla and Turo, enabling CarSync to draw the Supercharger expenses from Tesla, format an invoice, and with the press of only one button, we can send the invoice and receipts to our guests after their trip,” the letter reads. “As Power & All-Star Hosts dealing with hundreds of trips, we don’t have the time and bandwidth to operate our businesses without automation of these Supercharger expenses. Along the same lines, CarSync makes it super simple to automate collection of toll reimbursements and related receipts.”

CarSync has also recently integrated with Lula to offer an insurance product that insures vehicles “when not on a guest trip,” which has been helpful for hosts’ auto loans. Turo has not shared plans to provide its own insurance platform for hosts.

CarSync said it was disappointed by Turo’s decision, “especially given that Turo is a peer-to-peer sharing network, this goes against the openness and collaboration that is in the spirit of P2P,” said Mihajlovic, who noted that Airbnb works to promote external partners through its developer program.

CarSync was founded in 2019 specifically with the car-sharing business in mind, and now plans to pivot and focus on helping companies that rent cars to Uber drivers manage their fleets.

“Still, given that we have built a brand and have a loyal user base, we are also thinking of a product to continue the CarSync brand and provide fleet management functionalities to smaller fleets,” said Mihajlovic. “It definitely hurts given that our ‘free’ business model was starting to work and we were scaling like crazy, however lessons are learned and we’re moving on.”

Fleetwire, another popular third-party service, offers hosts a way to list all of their Turo vehicles on a user-friendly website that directs renters back to Turo. TechCrunch was unable to reach Fleetwire for comment.